How To Redact 4506 T Form online?

Easy-to-use PDF software

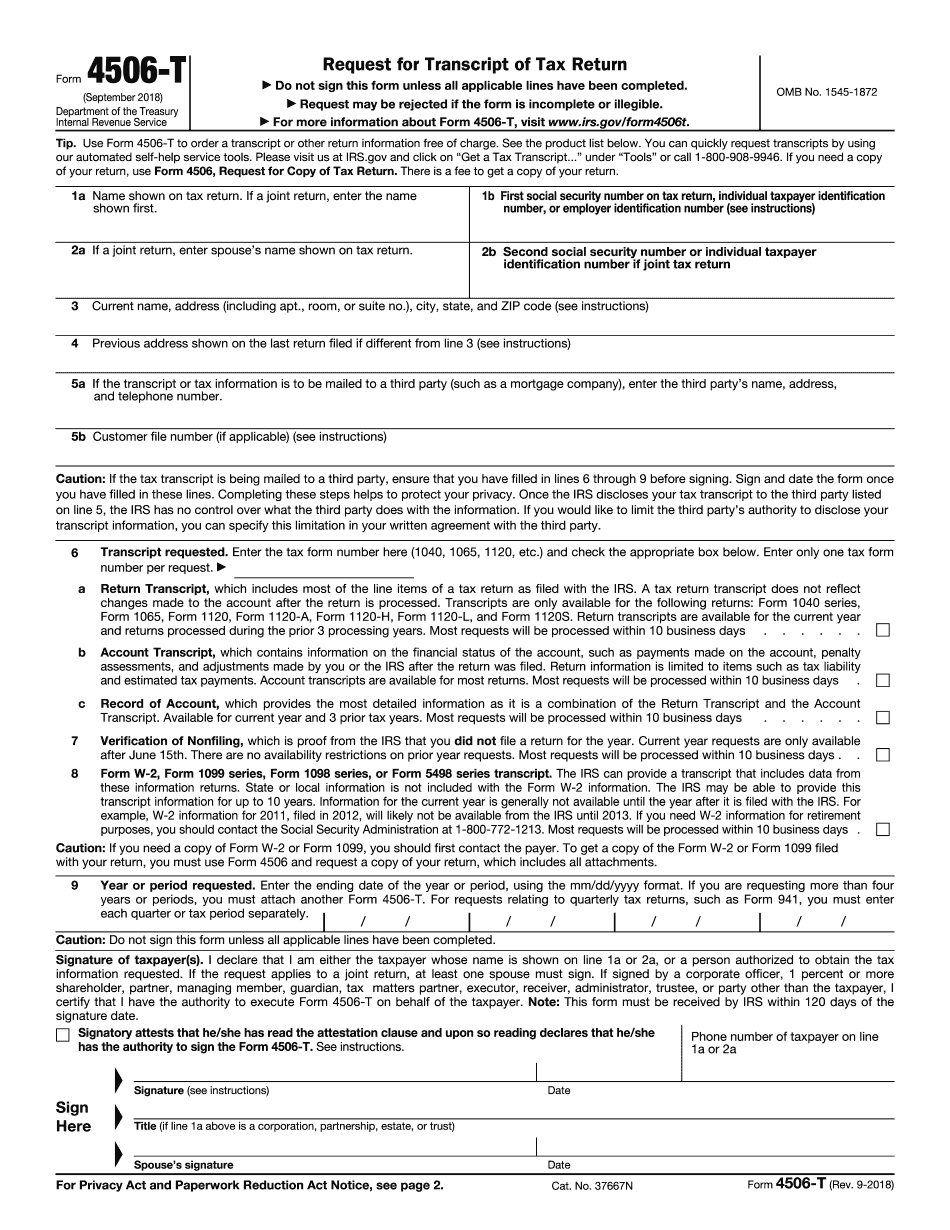

What is 4506 T Form?

The IVES Request for Transcript of Tax Return (IRS Form 4506-C) provides the borrower's permission for the lender to request the borrower's tax return information directly from the IRS using the IRS Income Verification Express Service (IVES).

How to Redact 4506 T Form

Work on documents online hassle-free, leaving software installation, downloads, and other follow-ups behind. Our web-based editor offers you all the tools you might need to enhance records. Using the solution, you can manage, modify, and Redact 4506 T Form without extra steps. Follow the guidelines below to check it out and find out more benefits:

- Open a document with the built-in editor.

- Start typing information in any field and press Enter to move on.

- Сheck out the solution's toolbar to refine the look of your document.

- Using instruments, you can add images, manage pages and so on.

- Select a tool and apply it to the page you want.

- Save edits by clicking Done.

- Share your form via a link, send it as an email, download it or print it out.

Make the most out of the service to put in order a flexible editing workflow. Process documents and Redact 4506 T Form in clicks using the cross-platform solution from any device. Now, to cope with the paperwork and burdensome tasks, you need only a strong internet connection. Throw the piles of papers that clutter your workplace away and keep all files at your fingertips from anywhere, anytime.

Advantages to Redact 4506 T Form here

Don't waste time comparing a dozen solutions. Try our service and find out how to Redact 4506 T Form in the most straightforward way. You can get access to the toolkit and say goodbye to all PDF-related issues. Our online solution helps you edit content as you like seamlessly and create good-looking documents via your device without extra software. Build a workflow where you can feel free to focus on important things for you and your business while our platform supplies you with everything else:

- Secure workflow

- Regular access to data

- Advanced editor

- Web-based solution

- User-friendly interface

Available from any device:

- Smartphone or iPhone

- Tablet or iPad

- Laptop or PC

Need a template of 4506 T Form ?